Maryland State Title Processing Procedures

- What form of title must an insurer obtain in connection with the sale of a vehicle that has been acquired through the settlement of a claim?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Salvage branded “Damage is greater than 75% of fair market value and repairable”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Salvage branded “damage is 75% or less of the fair market value”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Salvage branded “Flood”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Salvage branded “parts”?

- What documents must an insurer provide to CarBuyerUSA in order to sell a recovered theft vehicle recovered substantially intact with no substantial damage, where title is still in the name of the insured?

- What steps must an insurer take in Maryland to process an owner-retained vehicle?

- What legal duties are imposed upon a lienholder following satisfaction of the lien?

- What form of title must an insurer obtain in connection with the sale of

a vehicle that has been acquired through the settlement of a claim?

Excerpts from Maryland state law regarding titling of vehicles acquired by insurance companies may be found below.

Maryland Transportation Code § 11-152(a) - Salvage.

-

(a) "Salvage" means any vehicle that:

(1) Has been damaged by collision, fire, flood, accident, trespass, or other occurrence to the extent that the cost to repair the vehicle for legal operation on a highway exceeds 75% of the fair market value of the vehicle prior to sustaining the damage;

(2) Has been acquired by an insurance company as a result of a claim settlement; or

(3) [omitted]

-

Salvage certificate issued in name of applicant

(a)(1) A salvage certificate shall be issued in accordance with the provisions of this section.

(2) A salvage certificate issued under this section shall:

-

(i) Be issued in the name of the applicant; and

(ii) Serve as an ownership document.

(a-1) For purposes of this section, a vehicle has not been acquired by an insurance company if an owner retains possession of the vehicle upon settlement of a claim concerning the vehicle by the insurance company in accordance with § 13-506.1 of this subtitle.

Issuance of salvage certificate

(b) The Administration shall issue a salvage certificate:-

(1) To an insurance company or its authorized agent that:

-

(i) Is licensed to insure automobiles in this State;

(ii) Acquires a vehicle as the result of a claim settlement; and

(iii) Within 10 days after the date of settlement, applies for a salvage certificate as provided in subsection (c) of this section;-

(i) Acquires a salvage vehicle from a source other than an

insurance company licensed to insure automobiles in this

State; (ii) Acquires a salvage vehicle by a means other than a transfer of a salvage certificate; and

(iii) Applies for a salvage certificate as provided in subsection (d) of this section; or-

(i) Acquires or retains ownership of a vehicle that is salvage,

as defined in § 11-152 of this article;

(ii) Applies for a salvage certificate on a form provided by the Administration; and

(iii) Pays a fee established by the Administration.-

(i) For a salvage certificate on a form provided by the

Administration for a vehicle titled in the State; or

(ii) Electronically for a salvage certificate for a vehicle titled in a foreign jurisdiction.

-

(i) The certificate of title of the vehicle;

(ii) A statement by the insurance company that:

-

1. The cost to repair the vehicle for highway operation is

greater than 75% of the fair market value of the vehicle prior

to sustaining the damage for which the claim was paid and the

vehicle is repairable;

2. The vehicle is not rebuildable, will be used for parts only, and is not to be retitled;

3. The vehicle has been stolen;

4. The vehicle has sustained flood damage; or

5. The vehicle has been acquired by an insurance company as a result of a claim settlement and the cost to re-pair the vehicle is 75% or less of the fair market value of the vehicle prior to sustaining the damage for which the claim was paid; and

(4) To determine the cost to repair a vehicle for highway operation for purposes of § 11-152 of this article and paragraph (2)(ii) of this subsection, a person may not use the cost of:

-

(i) Towing, storage, or vehicle rental; or

(ii) Repairing cosmetic damage.

(6) The Administration, in consultation with the Department of State Police and other interested parties, shall adopt regulations to implement this subsection.

(d) through (g) intentionally omitted back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Salvage branded “damage is greater than

75% of the fair market value and repairable”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with a Salvage Application (VR28) and the appropriate fee to the Motor Vehicle Administration for processing.

Thereafter, the Motor Vehicle Administration shall issue a Certificate of Salvage branded “Damage is greater than 75% of the fair market value and repairable” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Salvage branded “Damage is greater than 75% of the fair market value and repairable” to the purchaser. [Maryland Transportation Code § 13-506] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Salvage branded “damage is 75% or less of

the fair market value”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair. CarBuyerUSA will submit these documents along with a Salvage Application (VR28) and the appropriate fee to the Motor Vehicle Administration for processing.

Thereafter, the Motor Vehicle Administration shall issue a Certificate of Salvage branded “damage is 75% or less of the fair market value” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Salvage branded “damage is 75% or less of the fair market value” to the purchaser. [Maryland Transportation Code § 13-506] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Salvage branded “Flood”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with a Salvage Application (VR28) and the appropriate fee to the Motor Vehicle Administration for processing.

Thereafter, the Motor Vehicle Administration shall issue a Certificate of Salvage branded “Flood” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Salvage branded “Flood” to the purchaser. [Maryland Transportation Code § 13-506] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Salvage branded “Parts only, not to be retitled”?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement, a release of any liens, an ACV, and a letter from insurer requesting to sell the vehicle for parts only.

CarBuyerUSA will submit these documents along with a Salvage Application (VR28) and the appropriate fee to the Motor Vehicle Administration for processing.

Thereafter, the Motor Vehicle Administration shall issue a Certificate of Salvage branded “Parts only, not to be re-titled” in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Salvage branded “Parts only, not to be re-titled” to the purchaser. [Maryland Transportation Code § 13-506] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

recovered theft vehicle recovered substantially intact with no

substantial damage, where title is still in the name of the insured?

When a vehicle has been stolen, the insurer shall provide CarBuyerUSA with a Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer by insured or endorsed by insurer accompanied by a power of attorney from insured to insurer), an odometer disclosure statement with last known mileage, and a release of any liens.

After receipt of these documents, CarBuyerUSA will submit these documents along with a Salvage Application for a Certificate of Salvage and the appropriate fee to the Motor Vehicle Administration. The Motor Vehicle Administration will make the appropriate notation in its records for processing but will not issue a Salvage Certificate until the vehicle is recovered. The Motor Vehicle Administration will issue a Theft Letter to the insurer.

If the vehicle is recovered and vehicle removed from stolen list, the insurer will provide the Theft Letter to CarBuyerUSA. Thereafter, CarBuyerUSA will submit theft letter along with Salvage Application (VR28) to Motor Vehicle Administration for processing. After the Motor Vehicle Administration confirms the recovery with the appropriate law enforcement agency, the Certificate of Title will be returned to CarBuyerUSA.

CarBuyerUSA, acting upon a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s the Certificate of Salvage to the purchaser. [Maryland Transportation Code §§ 13-506, 13-507(c)] back to top

- What steps must an insurer take in Maryland to process an ownerretained vehicle?

Pursuant to Maryland Transportation Code § 13.506:

-

Retention of vehicle by owner

(a-1) For purposes of this section, a vehicle has not been acquired by an insurance company if an owner retains possession of the vehicle upon settlement of a claim concerning the vehicle by the insurance company in accordance with § 13-506.1 of this subtitle. back to top

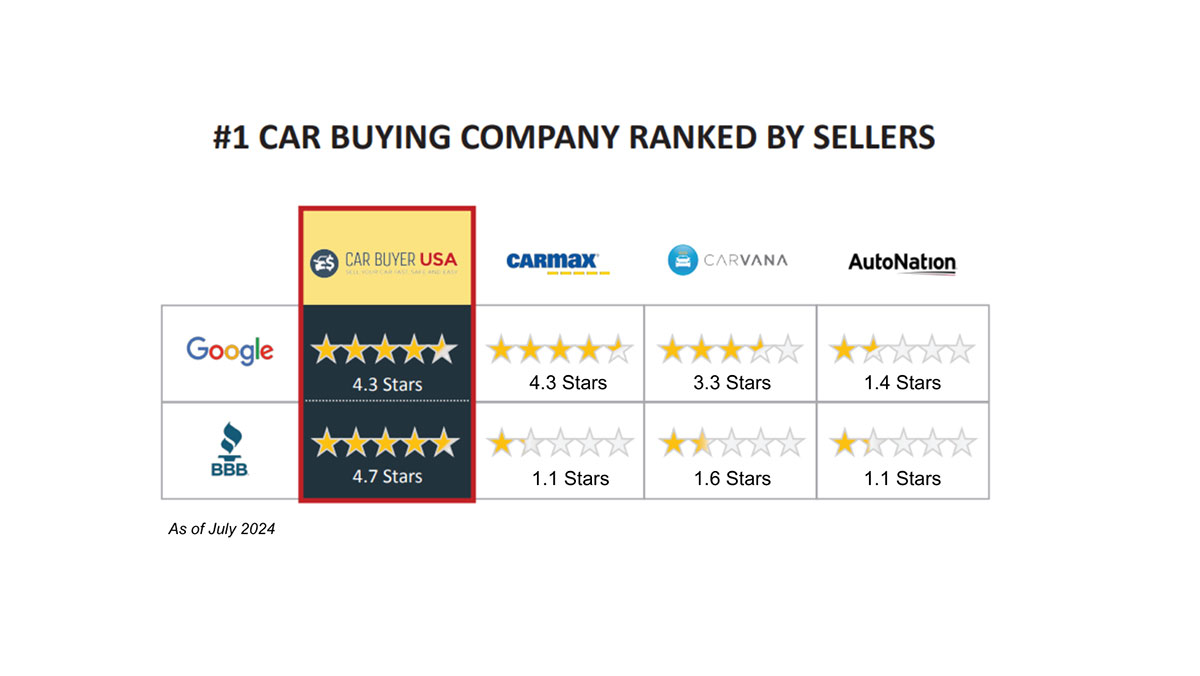

CarBuyerUSA's Ratings VS The Big Guys

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.

1

Get an Instant Cash Offer

Enter the Year, Make, Model, Trim Level & Miles (No VIN Required) and your cash offer appears onscreen (94% of the time)

2 Accept your offer

CarBuyerUSA offers are Cash Market Value.

Funds are guaranteed and paid at the time of pickup or drop-off

3Talk to an Agent

Your CarBuyerUSA representative schedules a no obligation inspection. In most markets an on-site mobile inspection can be arranged. The digital purchase agreement takes less than 60 seconds to complete.

4 Get Paid

When CarBuyerUSA picks up your truck, you are paid on the spot in full with guaranteed funds – entire process is hassle free.

Inspection, title work & pick up are all FREE.