Hawaii State Title Processing Procedures

- What form of title must an insurer obtain in connection with the sale of a vehicle that has been acquired through the settlement of a claim?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Salvage?

- What documents must an insurer provide to CarBuyerUSA in order to sell a recovered theft vehicle recovered substantially intact with no substantial damage, where title is still in the name of the insured?

- What steps must an insurer take in Hawaii to process an owner-retained vehicle?

- What legal duties are imposed upon a lienholder following satisfaction of the lien?

- What form of title must an insurer obtain in connection with the sale of a vehicle

that has been acquired through the settlement of a claim?

- Whenever a motor vehicle subject to registration under this part is sold as salvage or conveyed to an insurance company, in the ordinary course of business or as the result of a total loss insurance settlement where the insurance company receives the certificates of registration and ownership, the purchaser or, if an insurance company its authorized agent, shall within ten days from the purchase, or the settlement of the insurance loss, forward the motor vehicle's endorsed certificate of ownership or other evidence of title, certificate of registration, license plates, and an application for a salvage certificate as provided for in section 286-44.5, to the director of finance. If the certificate of registration or one or both license plates are lost, an affidavit, duly notarized and signed by the party responsible for the compliance of this section stating that the party has no knowledge of the location of the certificate of registration or the license plates, shall be filed with the director of finance of the county having jurisdiction over the vehicle. In any event the certificate of ownership or other evidence of title shall be forwarded to the director of finance.

- Upon receipt of the certificate of ownership, certificate of registration, license plates, and application for a salvage certificate, the director of finance shall issue a salvage certificate in the name of the purchaser or insurance company.

- Upon resale of the salvage vehicle, the seller or, if the seller is an insurance company, its authorized agent shall transfer the salvage certificate and issue a bill of sale to the purchaser which shall be on a form prescribed by the director of finance. The seller shall notify the purchaser, in writing, of the requirements of this chapter regarding the recertification of salvage vehicles. The seller shall sell the salvage vehicle only to a person licensed pursuant to chapter 437B, sections 289-4, or 445-232, or any person who executes an affidavit which states whether or not the salvage vehicle would be used to construct a rebuilt vehicle as defined in section 286-2 and that if the salvage vehicle is to be rebuilt, the purchaser will register the rebuilt vehicle as required by this chapter.

- intentionally omitted

- Whenever a certificate of registration and certificate of ownership is issued for

a motor vehicle with respect to which a salvage certificate has been previously

issued, the new certificates shall conform to the requirements of section 286-47

and:

- Bear the words "Rebuilt Vehicle"; and

- Appear in such a manner as to distinguish them from the certificate of registration and certificate of ownership for motor vehicles other than rebuilt or restored motor vehicles.

- In the event a total loss insurance settlement between an insurance company

and its insured or a claimant for property damage caused by its insured results in

the retention of the salvage vehicle by the insured or claimant, as the case may be,

then in such event, the insurance company or its authorized agent shall notify,

within ten days from the date of settlement, the director of finance of such

retention by its insured or claimant, as the case may be, and shall notify its

insured, or claimant as the case may be, in writing, of the requirements of this

chapter regarding the recertification of salvage vehicles. The notification shall be

on a form prescribed by the director of finance.

[Hawaii Revised Statutes § 286-48]

- An application for a salvage certificate shall be accompanied by a fee in an amount determined by the director of finance and shall contain:

- The name and address of the applicant;

- A description of the vehicle being salvaged; and

- Any further information reasonably required by the director of finance.

- A salvage certificate shall authorize the holder of the certificate to possess, transport but not drive upon a highway, and transfer ownership in a salvage vehicle.

- A salvage certificate shall contain the word "salvage" on the face of the

certificate and shall be made upon forms prescribed by the director of finance.

[Hawaii Revised Statute § 286-44.5] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle

on a Certificate of Title?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), license plates, Certificate of Registration, an odometer disclosure statement, and a release of any liens.

CarBuyerUSA will submit these documents along with an Application for Certificate of Title and the appropriate fee to the Division of Motor Vehicles for processing.

Thereafter, the Division of Motor Vehicles shall issue a Certificate of Title in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title to the purchaser. back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle

on a Certificate of Salvage?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), license plates, Certificate of Registration, an odometer disclosure statement, a release of any liens, and a letter from insurance company stating vehicle has been declared a total loss.

CarBuyerUSA will submit these documents along with an Application for Salvage Certificate and the appropriate fee to the Division of Motor Vehicles for processing.

Thereafter, the Division of Motor Vehicles shall issue a Certificate of Salvage in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Salvage to the purchaser.

[Hawaii Revised Statutes §§ 286-48; 286-44.5] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

recovered theft vehicle recovered substantially intact with no substantial

damage, where title is still in the name of the insured?

When a vehicle has been stolen and recovered, the insurer shall provide CarBuyerUSA with a Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), license plates, Certificate of Registration, an odometer disclosure statement with last known mileage, a release of any liens, and a letter from insurance company stating the vehicle has been declared a total loss.

After receipt of these documents, CarBuyerUSA will submit these documents along with an Application for Salvage Certificate and the appropriate fee to the Division of Motor Vehicle for processing.

Thereafter, the Division of Motor Vehicle shall issue the appropriate title depending upon the damage to the vehicle.

CarBuyerUSA, acting upon a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s appropriate Title to the purchaser. back to top

- What steps must an insurer take in Hawaii to process an owner-retained

vehicle?

In the event a total loss insurance settlement between an insurance company and its insured or a claimant for property damage caused by its insured results in the retention of the salvage vehicle by the insured or claimant, as the case may be, then in such event, the insurance company or its authorized agent shall notify, within ten days from the date of settlement, the director of finance of such retention by its insured or claimant, as the case may be, and shall notify its insured, or claimant as the case may be, in writing, of the requirements of this chapter regarding the recertification of salvage vehicles. The notification shall be on a form prescribed by the director of finance.

[Hawaii Revised Statutes § 286-48(f)] back to top

- What legal duties are imposed upon a lienholder following satisfaction of the

lien?

No specific requirements. back to top

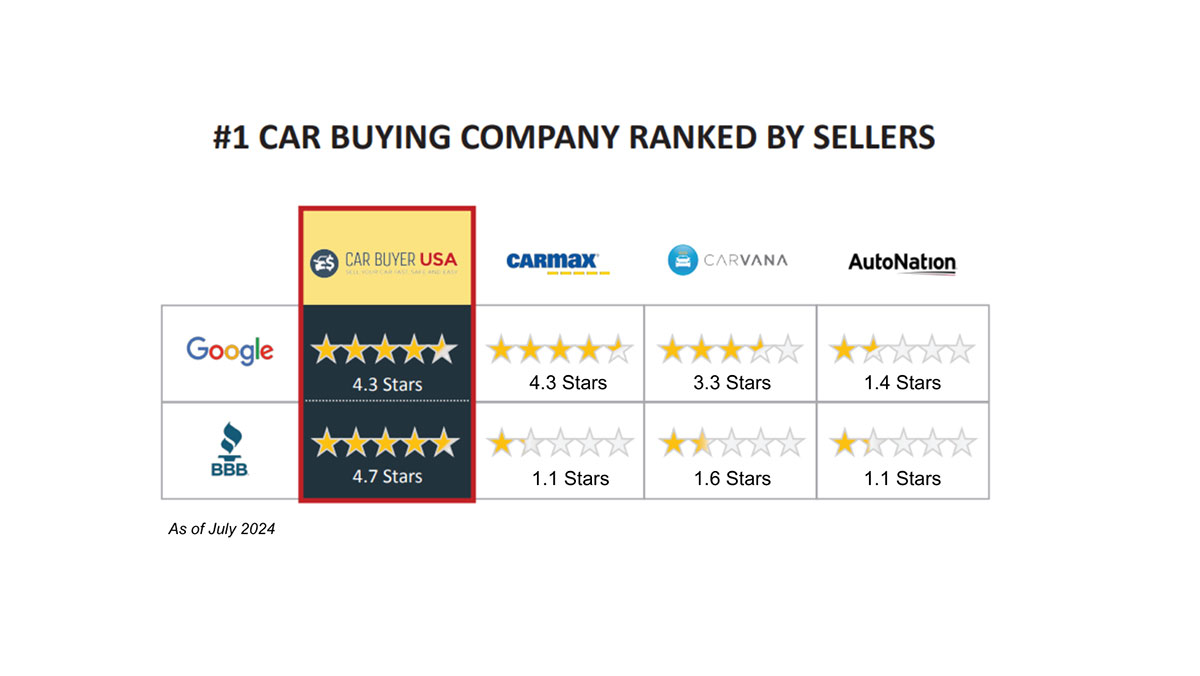

CarBuyerUSA's Ratings VS The Big Guys

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.

1

Get an Instant Cash Offer

Enter the Year, Make, Model, Trim Level & Miles (No VIN Required) and your cash offer appears onscreen (94% of the time)

2 Accept your offer

CarBuyerUSA offers are Cash Market Value.

Funds are guaranteed and paid at the time of pickup or drop-off

3Talk to an Agent

Your CarBuyerUSA representative schedules a no obligation inspection. In most markets an on-site mobile inspection can be arranged. The digital purchase agreement takes less than 60 seconds to complete.

4 Get Paid

When CarBuyerUSA picks up your truck, you are paid on the spot in full with guaranteed funds – entire process is hassle free.

Inspection, title work & pick up are all FREE.