Florida State Title Processing Procedures

- What form of title must an insurer obtain in connection with the sale of vehicle that has been acquired through the settlement of a claim?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Title (clean)?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Salvage Certificate of Title?

- What documents must an insurer provide to CarBuyerUSA in order to sell a vehicle on a Certificate of Destruction?

- What documents must an insurer provide to CarBuyerUSA in order to sell a recovered theft vehicle?

- What steps must an insurer take in Florida to process an owner-retained vehicle?

- What legal duties are imposed upon a lienholder following satisfaction of the lien?

- What form of title must an insurer obtain in connection with the sale of

a vehicle that has been acquired through the settlement of a claim?

There are three primary title types in Florida available to an insurer in connection with the sale of a vehicle that has been acquired through the settlement of a claim:

-

CERTIFICATE OF TITLE (clean): If the vehicle is worth less than $1,500

retail in undamaged condition in any official used motor vehicle guide or used

mobile home guide, or is a stolen motor vehicle recovered in substantially

intact condition and readily resalable without extensive repairs to or

replacement of the frame or engine.

SALVAGE CERTIFICATE OF TITLE (rebuildable): If the vehicle is worth more than $1,500 retail in undamaged condition in any official used motor vehicle guide or used mobile home guide, AND is not a stolen motor vehicle recovered in substantially intact condition and readily resalable without extensive repairs to or replacement of the frame or engine, AND the estimated costs of repairing the physical and mechanical damage to the vehicle is less than 80 percent of the current retail cost of the vehicle, as established in any official used car or used mobile home guide.

CERTIFICATE OF DESTRUCTION (unrebuildable): If the vehicle is worth more than $1,500 retail in undamaged condition in any official used motor vehicle guide or used mobile home guide, AND is not a stolen motor vehicle recovered in substantially intact condition and readily resalable without extensive repairs to or replacement of the frame or engine, AND the estimated costs of repairing the physical and mechanical damage to the vehicle are equal to 80 percent or more of the current retail cost of the vehicle, as established in any official used car or used mobile home guide.

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Title (clean)?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement, a release of any liens, and an ACV.

CarBuyerUSA will submit these documents along with an Application for Certificate of Title (Form HSMV 82040) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Certificate of Title in the name of the insurer. CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Title to the purchaser.

[Florida Motor Vehicles Code § 319.30(3)(b)] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Salvage Certificate of Title?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with an Application for Salvage Title/Certificate of Destruction (form HSMV 82363) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Salvage Certificate of Title in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Salvage Certificate of Title to the purchaser.

[Florida Motor Vehicles Code § 319.30(3)(b)] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

vehicle on a Certificate of Destruction?

The insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with an Application for Salvage Title/Certificate of Destruction (form HSMV 82363) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Certificate of Destruction in the name of the insurer.

CarBuyerUSA, acting under a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s Certificate of Destruction to the purchaser.

[Florida Motor Vehicles Code § 319.30(3)(b)] back to top

- What documents must an insurer provide to CarBuyerUSA in order to sell a

recovered theft vehicle?

When a vehicle has been stolen, the insurer shall provide CarBuyerUSA with a Certificate of Title or comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement with last known mileage, a release of any liens, and an ACV.

After receipt of these documents, CarBuyerUSA will submit these documents along with an Application for Salvage Title/Certificate of Destruction (HSMV 82363) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Certificate of Title stamped "Salvage Theft" in the name of the insurer. Upon receipt, CarBuyerUSA will forward Certificate of Title stamped "Salvage Theft" to the insurer for safekeeping.

If the vehicle is recovered, the Certificate of Title stamped "Salvage Theft" along with a cost of repair and a theft affidavit will be returned to CarBuyerUSA by the insurer in order to obtain the appropriate title depending upon the year of the vehicle and damage to the vehicle.

CarBuyerUSA, acting upon a power of attorney for the insurer, will then sell the vehicle at auction and reassign the insurer’s appropriate title to the purchaser.

[NOTE: If a vehicle is recovered before a Certificate of Title stamped "Salvage Theft" is obtained, the appropriate title as explained in nos. 2, 3 or 4 can be obtained. A theft affidavit stating that this vehicle was stolen and recovered should accompany such application.]

[Florida Motor Vehicles Code § 319.30(3)(b)] back to top

- What steps must an insurer take in Florida to process an ownerretained vehicle?

Florida Motor Vehicles Code Title XXIII, Chapter 319.30(3)(b), requires that insurers acquire title to all total loss vehicles. As a result, in a situation where the insured desires to retain the vehicle, the insurer must first go on title using the procedure set forth below, and then reassign title back to the insured.

If Florida law requires that a Salvage Certificate of Title be obtained, the insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with an Application for Salvage Title/Certificate of Destruction (form HSMV 82363) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Salvage Certificate of Title in the name of the insurer. The insurer will reassign the Salvage Certificate of Title to the insured, and the insurer will thereafter forward the assigned Salvage Certificate of Title to the insured.

If Florida law requires that a Certificate of Destruction be obtained, the insurer shall provide CarBuyerUSA with a Certificate of Title or a comparable ownership document issued by another state or jurisdiction (either endorsed over to the insurer or accompanied by a power of attorney), an odometer disclosure statement, a release of any liens, an ACV, and a cost of repair.

CarBuyerUSA will submit these documents along with an Application for Salvage Title/Certificate of Destruction (form HSMV 82363) and the appropriate fee to the DMV for processing.

Thereafter, the DMV shall issue a Certificate of Destruction in the name of the insurer. The insurer will reassign the Certificate of Destruction to the insured, and the insurer will thereafter forward the assigned Certificate of Destruction to the insured.

NOTE: Vehicles worth less than $1,500 retail in undamaged condition as listed in any official used motor vehicle guide are exempt from the provision of this law.

[Florida Motor Vehicles Code § 319.30(3)(b)] back to top

- What legal duties are imposed upon a lienholder following satisfaction

of the lien?

Following satisfaction of lien, the lienholder must enter a satisfaction notation in the space provided for it on the certificate of title and execute a satisfaction of lien on a form provided by the DMV (form HSMV 82260). If the certificate of title was retained by the owner, the owner must provide the title to the lienholder within five days of lien satisfaction. If no subsequent liens are indicated on the title, the lienholder delivers the title to the owner and the executed satisfaction of lien to the DMV; if additional liens are shown on the title, the lienholder delivers the executed satisfaction of lien to the owner and the title to the DMV. The documents must be sent to the relevant parties within ten days of the satisfaction of the lien. If the lienholder fails to furnish a satisfaction of lien within 30 days following demand for satisfaction of lien by the owner, the lienholder will be liable for all costs, damages, and expenses, including reasonable attorney's fees, incurred in a suit brought in Florida for cancellation of the lien.

[Florida Motor Vehicles Code § 319.24(5)] back to top

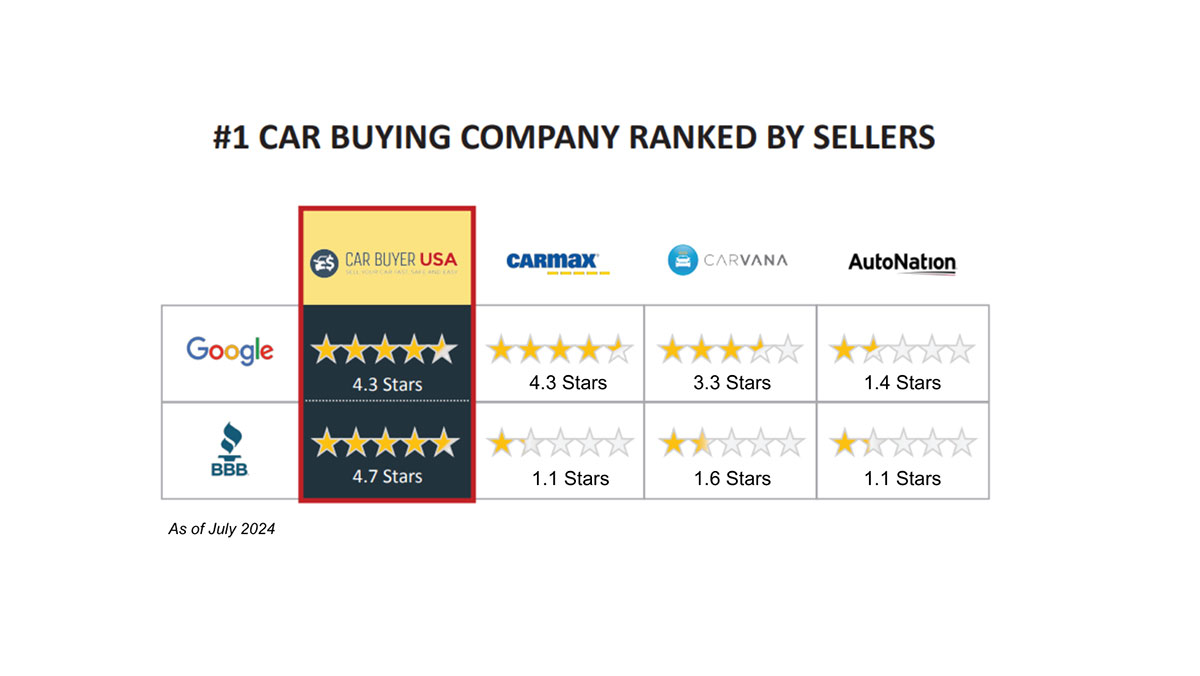

CarBuyerUSA's Ratings VS The Big Guys

How It Works

We pay cash for cars, trucks, & SUVs, in any condition, anywhere in the Continental USA.

1

Get an Instant Cash Offer

Enter the Year, Make, Model, Trim Level & Miles (No VIN Required) and your cash offer appears onscreen (94% of the time)

2 Accept your offer

CarBuyerUSA offers are Cash Market Value.

Funds are guaranteed and paid at the time of pickup or drop-off

3Talk to an Agent

Your CarBuyerUSA representative schedules a no obligation inspection. In most markets an on-site mobile inspection can be arranged. The digital purchase agreement takes less than 60 seconds to complete.

4 Get Paid

When CarBuyerUSA picks up your truck, you are paid on the spot in full with guaranteed funds – entire process is hassle free.

Inspection, title work & pick up are all FREE.