Dealing with negative equity on a car loan can be challenging. This situation, also known as being "upside down" or "underwater," happens when the amount you owe on your vehicle is more than its current market value. In fact, recent data shows that 40% of new car buyers face this issue.

Cars lose value quickly, especially right after purchase. If you finance the full purchase price or roll over debt from a previous vehicle, you might end up with a loan that's higher than the car's value. While extending the loan term can lower monthly payments, it also means it takes longer to build equity in your vehicle. The implications of negative equity can wreak havoc on you financially and cause financial strain. When trading in a vehicle with negative equity, the outstanding loan balance must be paid off, which may require additional cash or rolling the negative equity into the new loan. This can and most likely will cause lenders to charge higher interest rates on new loans to cover the risk associated with financing negative equity.

Now, exactly how do you break out? There are a couple of ways to tackle the challenge, some may not be feasible for many. Contributing additional payments towards the principal can help reduce the loan balance more quickly or even switching to bi-weekly payments can effectively add one extra payment per year. Another option would be to refinance the loan. By refinancing to a lower interest rate can reduce monthly payments and help pay down the principal faster. You may also refinance with a shorter term can increase monthly payments but reduce the total interest paid and build equity faster.

If you are thinking about selling your negative equity vehicle, many owners will go straight to a dealership in high hopes the dealer will pay off the vehicle at trade-in. The dealership will roll the negative equity into the loan for your new vehicle. This means your new loan will include the amount you still owe on your old car in addition to the cost of the new car, hence creating negative equity almost immediately on the new vehicle loan. While a dealership can help you trade in a car with negative equity, it's important to understand the financial implications. Carefully consider your options and budget before proceeding to ensure you're making a financially sound decision.

Breaking free from negative equity without refinancing or making extra payments is challenging but possible with careful planning and consideration of alternative strategies. Evaluate your financial situation, explore all available options, and choose the approach that best aligns with your needs and goals. We encounter dozens of sellers each week that have negative equity that want out of the vehicle. For some, they want out of the payment and no longer need the vehicle which makes it somewhat easier but for many the best advice we can give is:

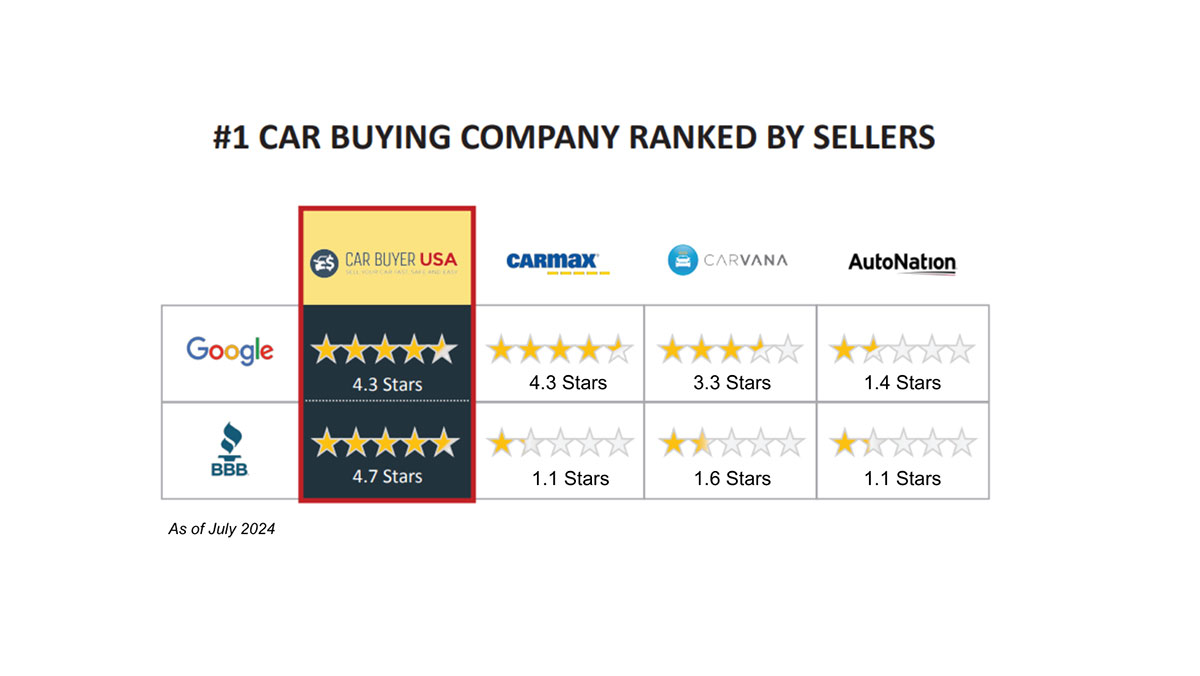

If your vehicle still functions and serves as good transportation, stay in the vehicle and continue to pay down the loan. If you drive less than average miles, making those additional payments will narrow the gap from actual cash value for your vehicle and the payoff amount. The less miles you drive the faster that gap will shrink and the car has to be maintained and cared for cosmetically also. Most importantly, get a cash offer for the vehicle from Car Buyer USA and bookmark our site. Offers are free and you can come get a price at any time and keep an eye on the negative equity. You may never get to “even” but your finances may improve and make it feasible to break out of the vehicle at some time in the future.