Will a dealer or an individual buy my car or truck with a lien?

When you want to sell your vehicle and you still owe the bank, who is going to buy it? Will you be paid enough to pay off the loan? When a vehicle has a lien, meaning there is a debt owed on the vehicle, the buyer pool narrows significantly. If you are wanting to sell to an individual, this buyer would be someone who is comfortable with the details of buying a vehicle with a lien.

Selling your car, truck or SUV with a lien can be a bit more complicated than you might think, especially if you have never done so to an individual. Start by contacting your lender to be sure they have secured the lien of your vehicle with a title. Your lender may also have a certain process or different stipulations for selling a financed vehicle. Even more so if your vehicle is leased instead of financed. Many leasing companies will only allow the lessee to buy out the lease, whereby some companies may allow a dealer to buy it out. We have run into several transactions where the leasing company has informed us, not the lessee, that the lessee is close to the end of their lease and the remaining lease cannot be bought by a dealer. Regular retail loans are much different, but it is always best to contact your lender prior to selling, to ensure an easy transaction for yourself and the buyer. When contacting your lender for information, be sure to obtain the amount owed. Having this upfront will assist you in determining the price of the vehicle you are selling.

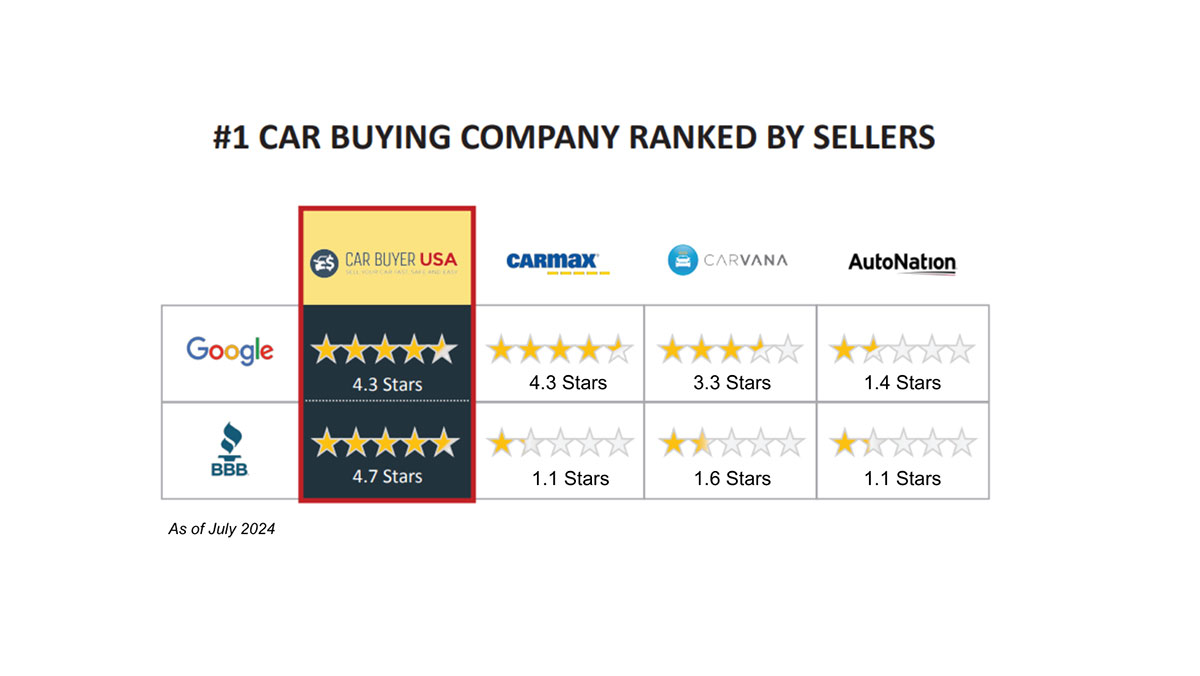

Car Buyer USA, as an automobile dealer, is more interested in purchasing a vehicle with a lien than most individual buyers. We have the resources and expertise to handle the process of paying off the lien. Many sellers and buyers do not want the hassle of dealing with lenders, especially if the lender is a large corporation. Obtaining the payoff quote and process, verifying the title and any other issues that may arise are things that many do not want to deal with. With security levels being raised in many banks and credit unions, some lenders do require verbal or written permission to obtain payoff information, while some even require a 3 way call. You can be sure that our associates are here to walk you through every step of the way to make your transaction as seamless as possible.