If you’re asking, “Who will buy my vehicle when I still owe the bank?” you’re not alone. Millions of drivers are upside-down, mid-loan, or simply not finished paying off their vehicle when life changes. A move, a new job, financial pressure, or just wanting out of a payment can all trigger the same concern: Can I even sell this car if there’s money still owed on it?

The short answer is yes—but how you sell it makes all the difference.

When a vehicle has a lien, it means a bank or lender legally owns part of it until the loan is paid off. That alone immediately shrinks your buyer pool. Most private buyers hesitate the moment they hear the word “lien.” It sounds risky, complicated, and unfamiliar—and for them, it usually is 😬.

Private buyers want clean titles and simple handoffs.

Selling a car with a lien to an individual requires a buyer who’s comfortable wiring money to a bank, waiting for a title release, trusting paperwork timelines, and navigating a process they’ve probably never done before. Even if they like your car, many walk away once they realize the title isn’t in hand. Those who don’t walk often demand a steep discount to “make the risk worth it.”

Dealerships aren’t much better.

While some dealers will buy a vehicle with a lien, their offers often reflect the inconvenience. The lien becomes a leverage point used to lower the price, slow the deal, or redirect you into a trade-in that benefits them more than you. Add in multiple appraisals, manager approvals, and payoff delays, and the experience can quickly become frustrating ⏳.

Before selling any vehicle with a lien, your first step should always be the lender.

You’ll need to confirm who holds the lien, whether the title is electronic or physical, and what their payoff process looks like. Payoff amounts change daily, and some lenders have strict requirements, verbal authorization, written consent, or even three-way calls. Lease situations can be even trickier. Some leasing companies allow only the lessee to buy out the lease, while others restrict dealer purchases altogether, especially near the end of the lease term.

Miss one of these details, and a sale can stall—or collapse entirely.

This is where CarBuyerUSA makes the process dramatically easier ✨.

CarBuyerUSA regularly purchases vehicles with active liens and has systems in place specifically to handle them. Instead of treating the lien as a problem, it’s treated as part of the process. Our team coordinates directly with lenders, obtains accurate payoff figures, verifies title status, and ensures the loan is handled correctly, without pushing that responsibility onto the seller.

For many people, the biggest relief is not having to talk to the bank at all 😌.

Large banks and credit unions have tightened security over the years. Payoff information isn’t always easy to access, and mistakes can delay title releases for weeks. Our experience with lenders nationwide helps prevent those delays and removes uncertainty from the transaction.

Even better, a lien doesn’t automatically mean a low offer.

Because we evaluate vehicles using current market demand, not fear or inconvenience, sellers often receive far more competitive pricing than they would from a private buyer or local dealer. The lien is paid off properly, the paperwork is handled correctly, and if there is any remaining equity, that will go to you 💵.

So who will buy your vehicle when you still owe the bank?

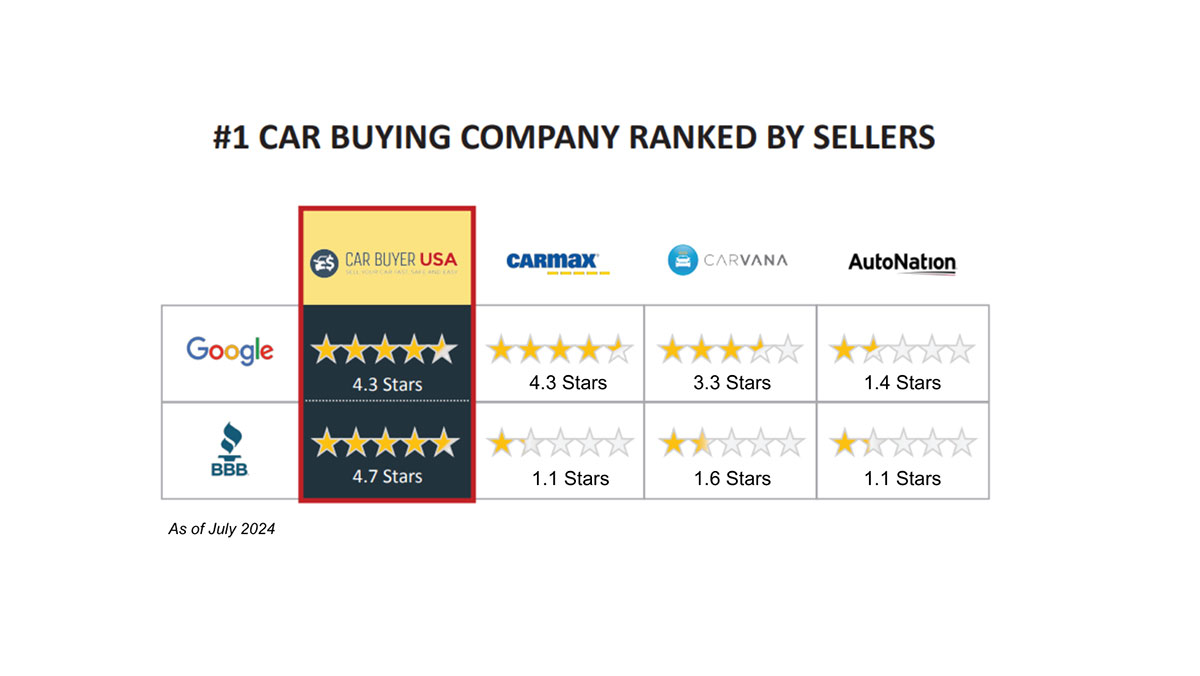

Private buyers might hesitate. Dealers may discount aggressively. But CarBuyerUSA is built for exactly this situation. If you want a smoother sale, fewer headaches, and the best possible value, even with a lien, selling to CarBuyerUSA turns a complicated problem into a clear, confident solution.

Sometimes the smartest move isn’t waiting until the loan is paid off, it’s choosing the right buyer to handle it the right way 🚀. Contact CarBuyerUSA.com to get it sold and paid in full!